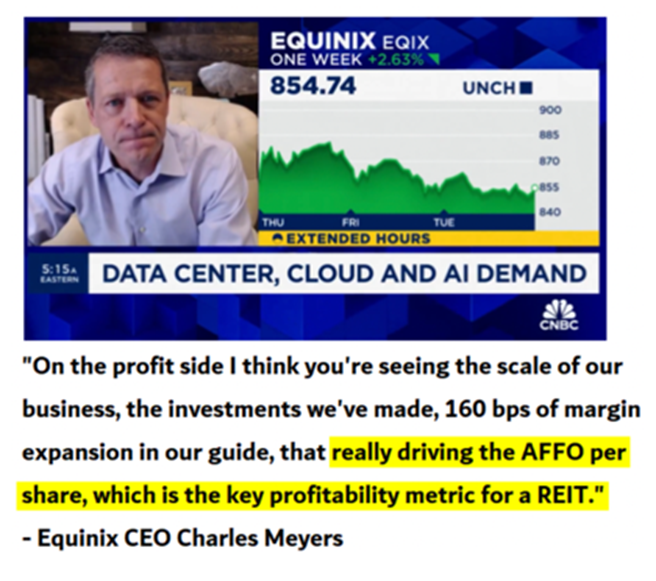

Hindenburg's latest report targets internet & data company Equinix on 'AI'

NEW FROM US: Equinix Exposed: Major Accounting Manipulation, Core Business Decay And Selling An AI Pipe Dream As Insiders Cashed Out Hundreds of Millions hindenburgresearch.com/equinix/ $EQIX (1/x)

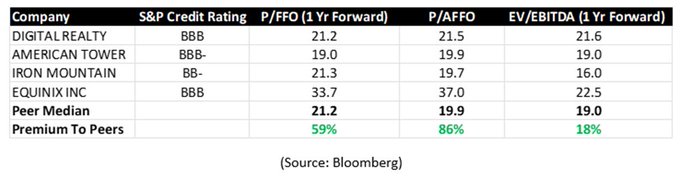

Equinix, a prominent data center boasting an $80 billion market capitalization and a vast network of over 260 facilities worldwide, has come under scrutiny due to allegations of significant accounting manipulation.